SIDF Lending Activity

Effective Performance with Promising Achievements

Lending Activity during 2021

The Fund continued its outstanding activity in the development of the local industrial sector, effectively while granting it a wide range of loans to support projects in various sectors in the Kingdom of the fiscal year 2021. The Fund’s performance this year was marked by a high percentage of loans approved by the Fund for industrial projects located in promising regions and cities; According to the facts and figures shown below:

| 2021 | 2020 | |

|

Loan

|

Number of approved loans |

Loan

|

|

SR Billion

|

Value of approved loans |

SR Billion

|

|

SR Billion

|

Total investments |

SR Billion

|

|

SR Billion

|

Disbursed amounts |

SR Billion

|

|

SR Billion

|

Repaid amounts |

SR Billion

|

Distribution of approved loans for NIDLP sectors

0

Industrial Projects (107 loans)

0

Logistic Projects (5 loans)

0

Energy Projects (5 loans)

Promising areas and cities during 2021

0 %

Of the total value of the approved loans worth SR 5.8 Billion, compared to (15%) before implementing regulations to increase the Fund’s funding ratio for these projects.

0 %

Of the total number of 41 approved loans, compared to 14% before the introduction of regulations to increase the Fund’s funding ratio for these projects.

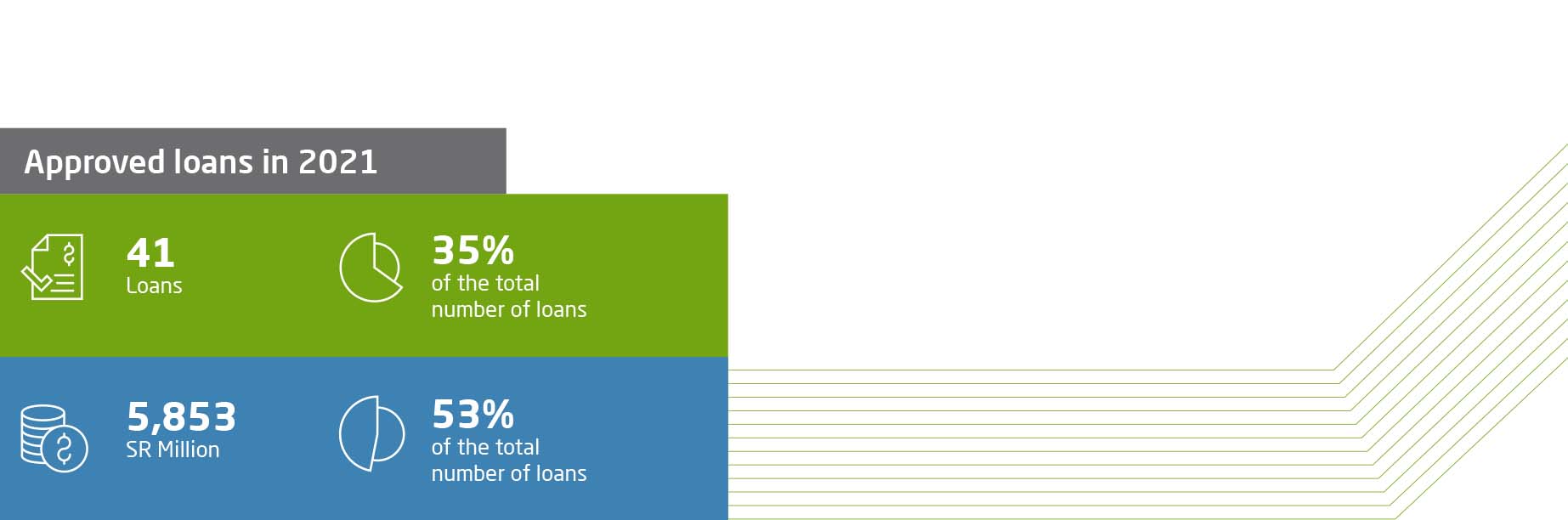

Loans for SMEs Projects in 2021

The fiscal year 2021 witnessed the adoption of a high percentage of loans for SMEs.

0 %

Percentage of total number for SMEs loans

0

value of SMEs loans

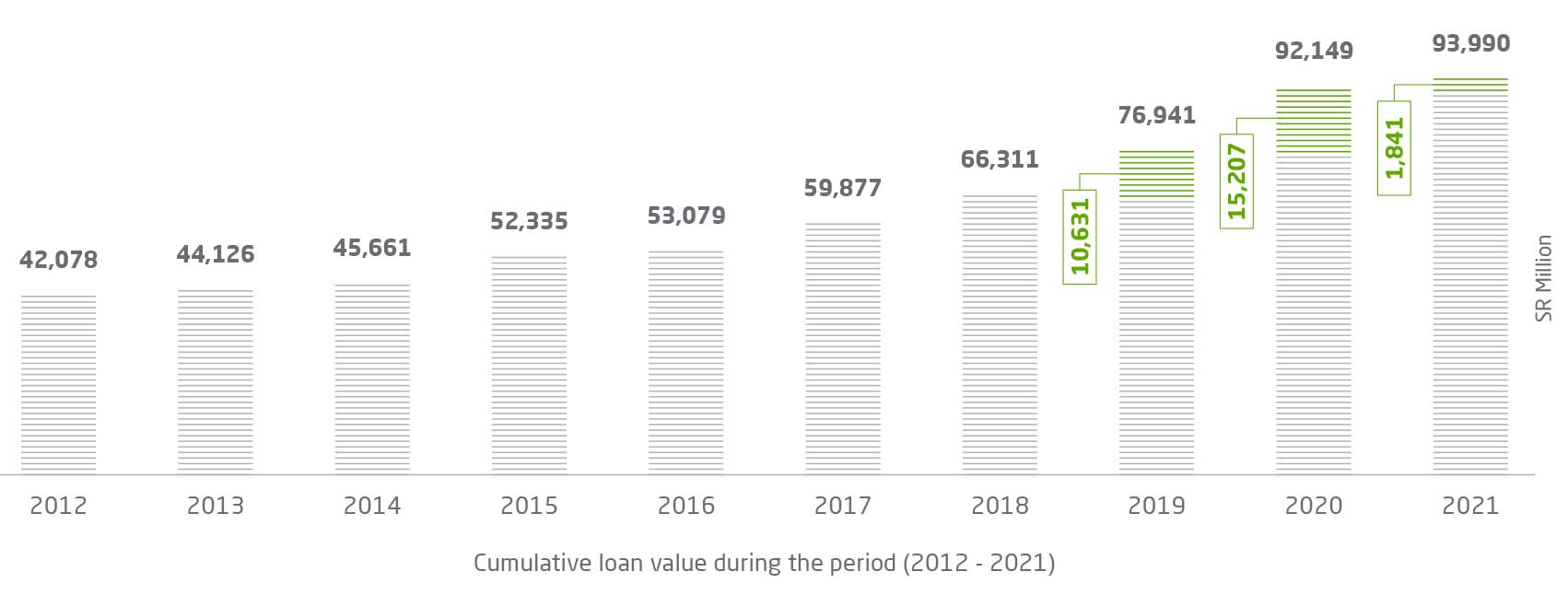

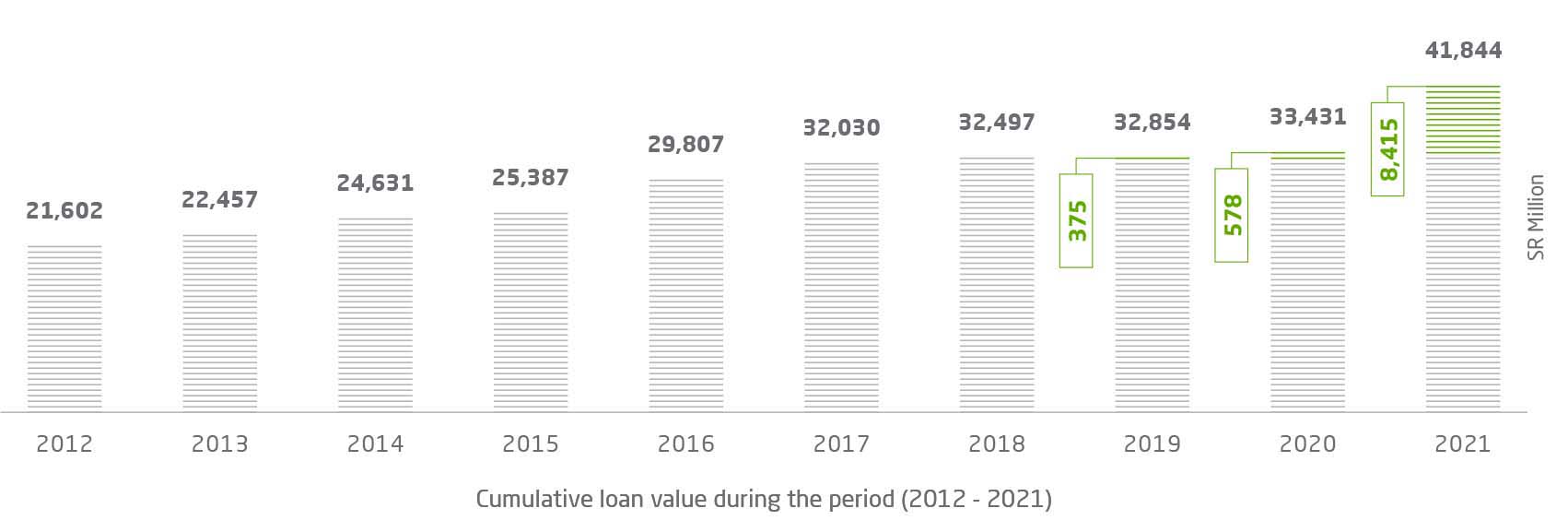

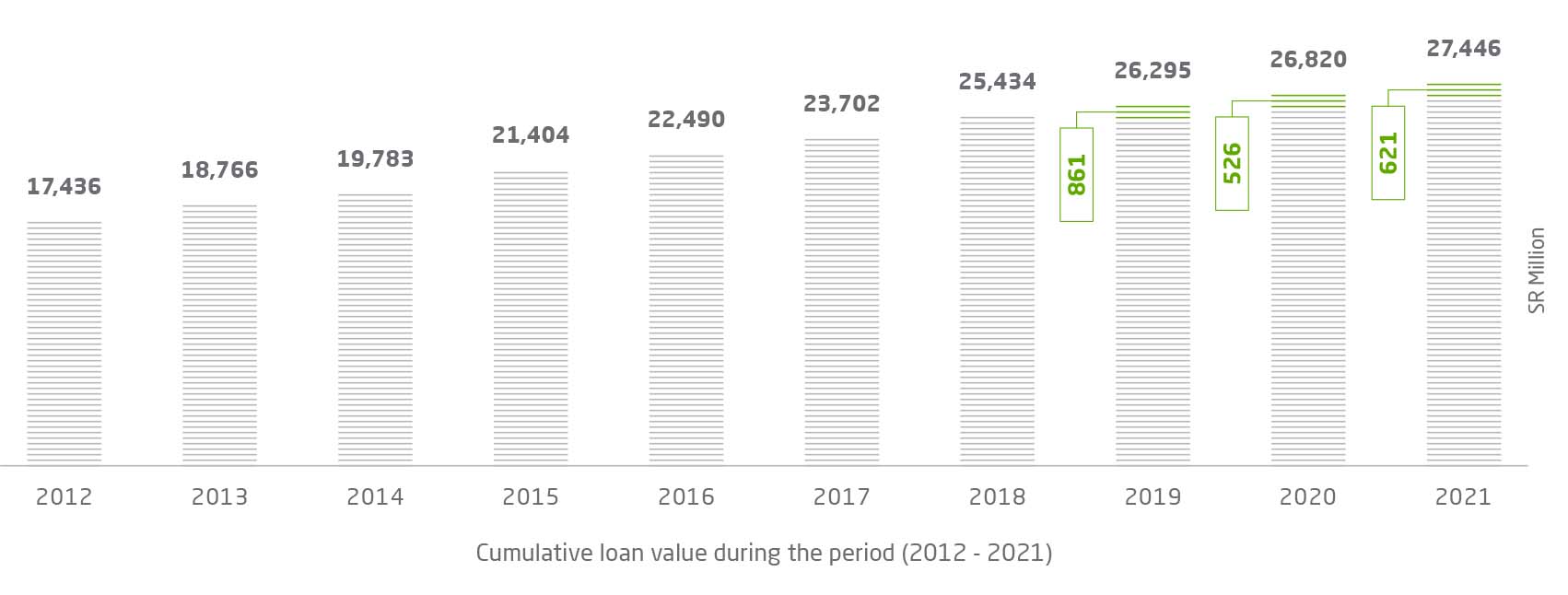

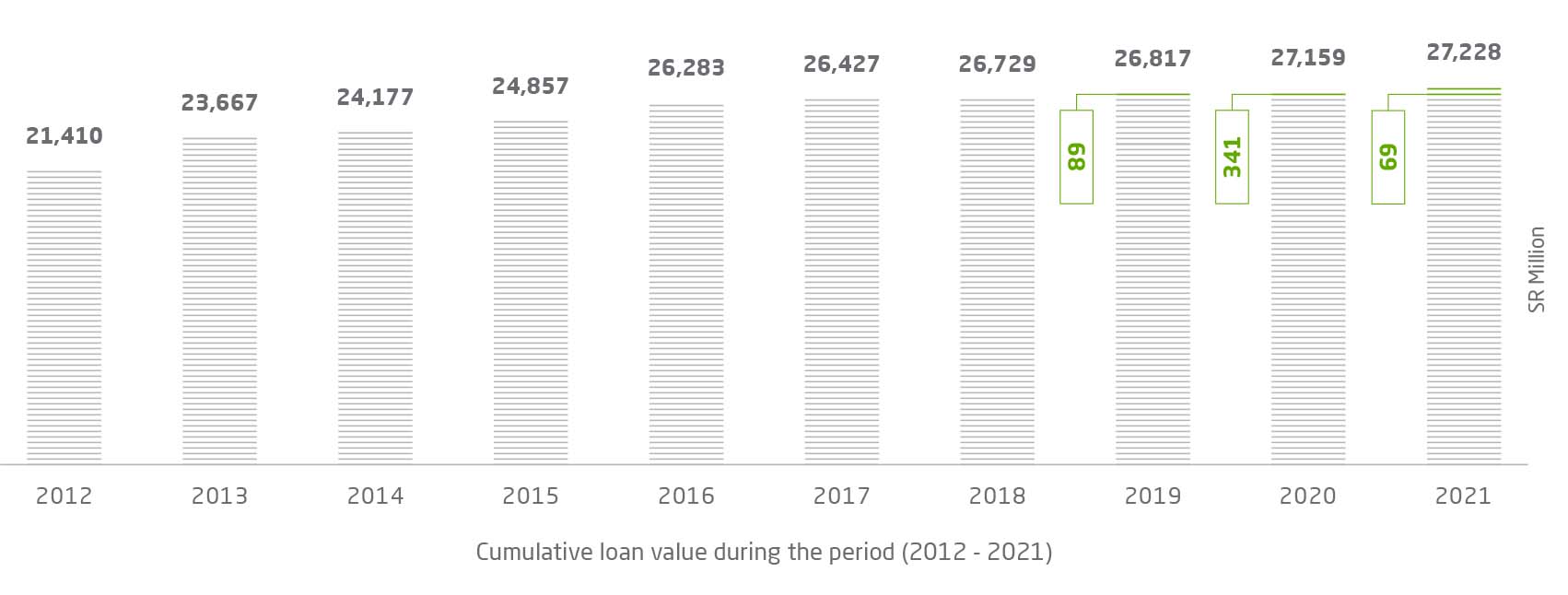

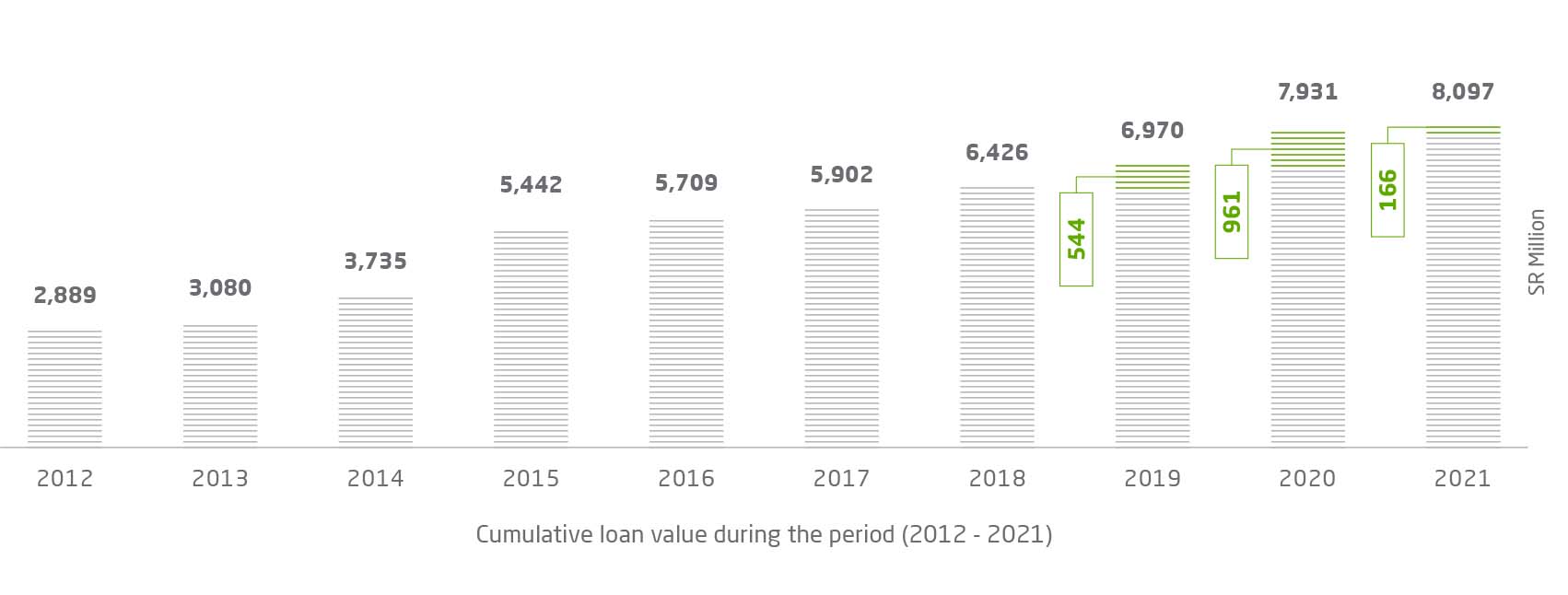

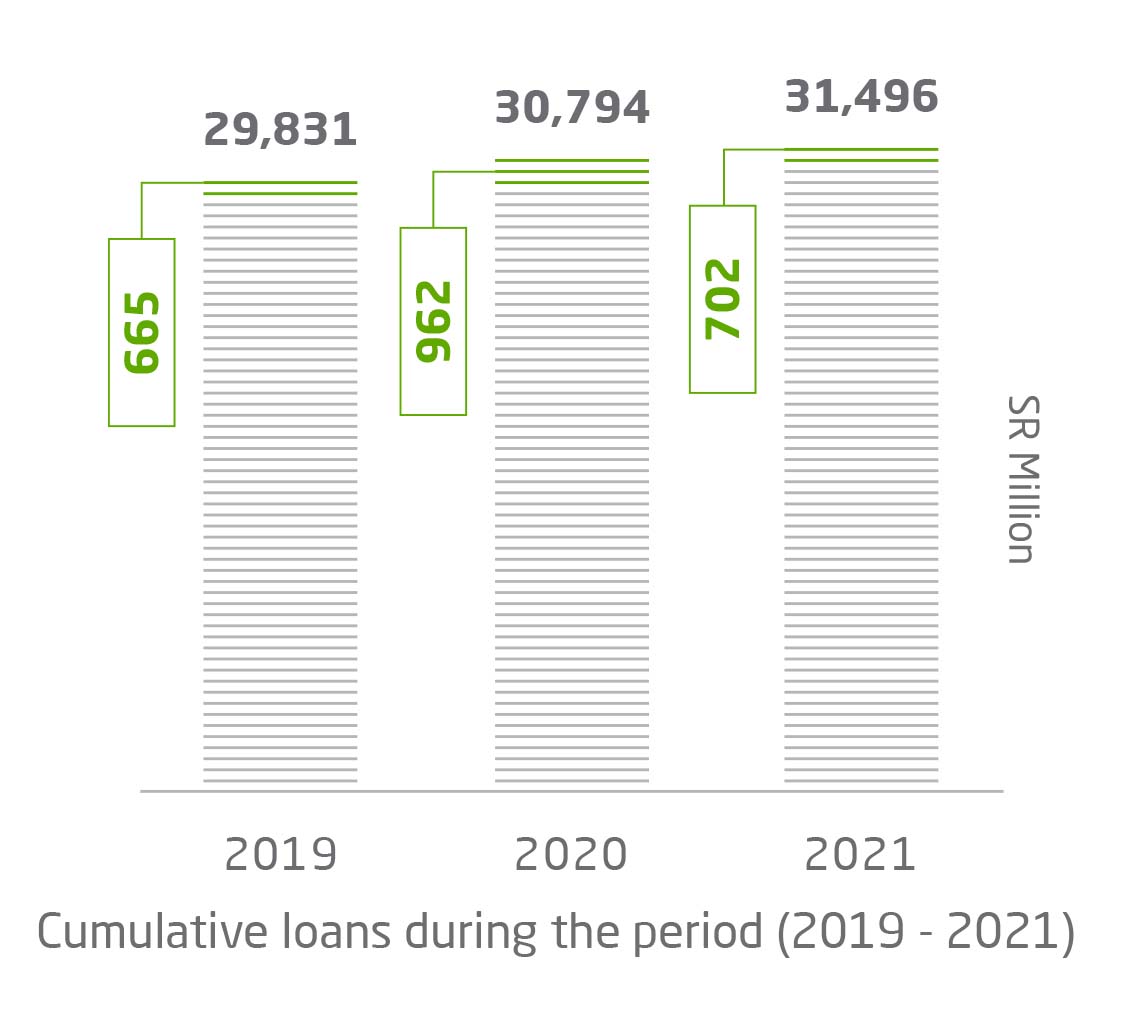

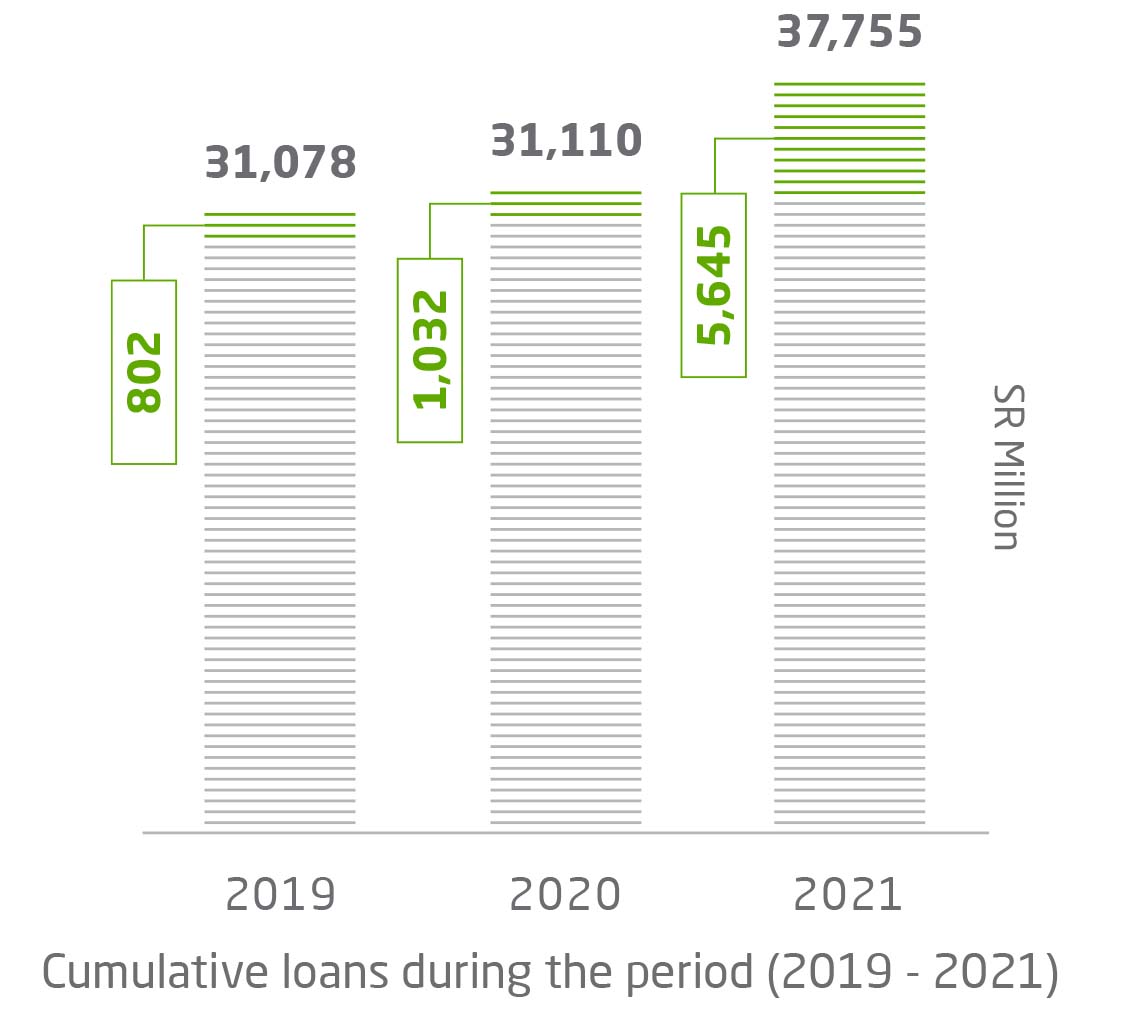

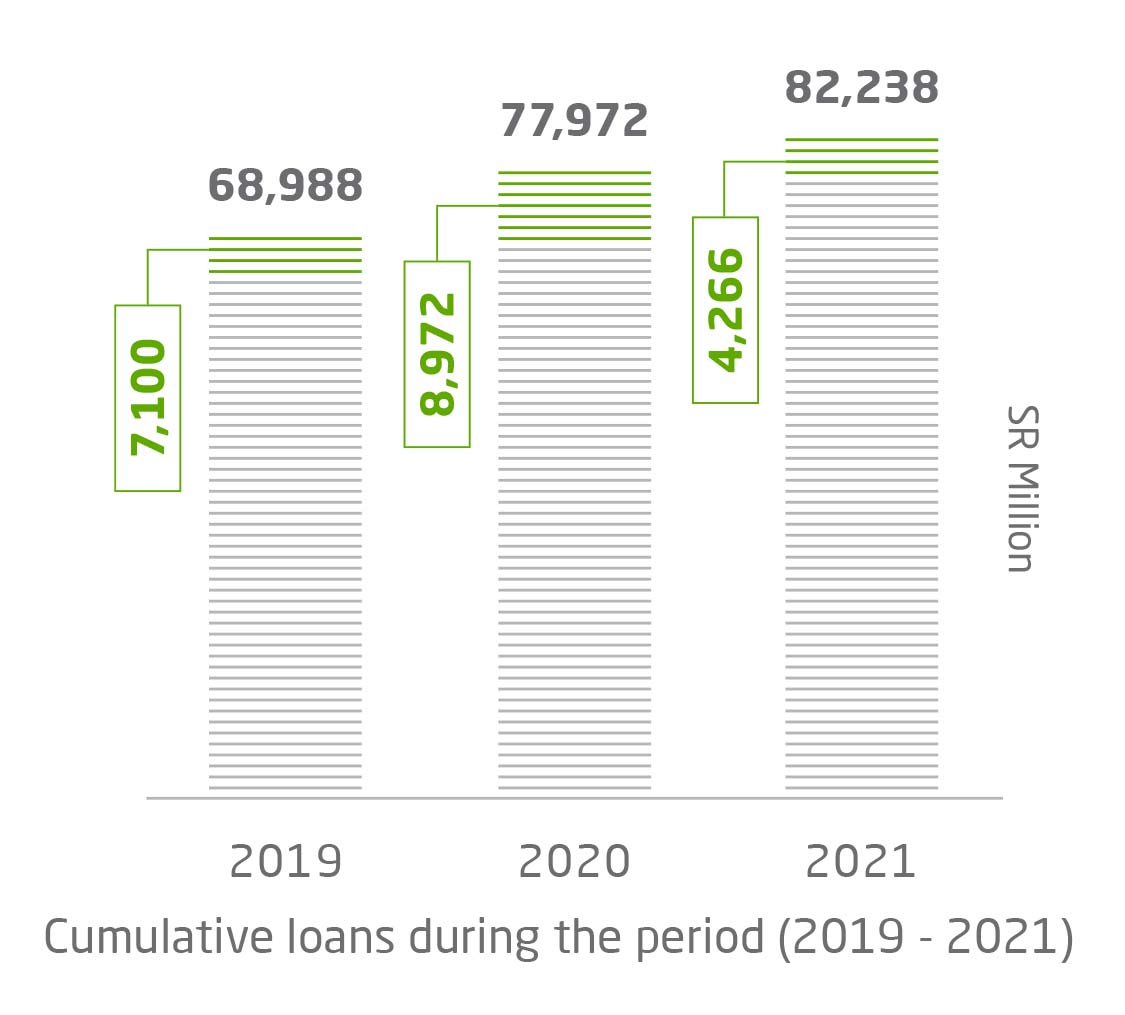

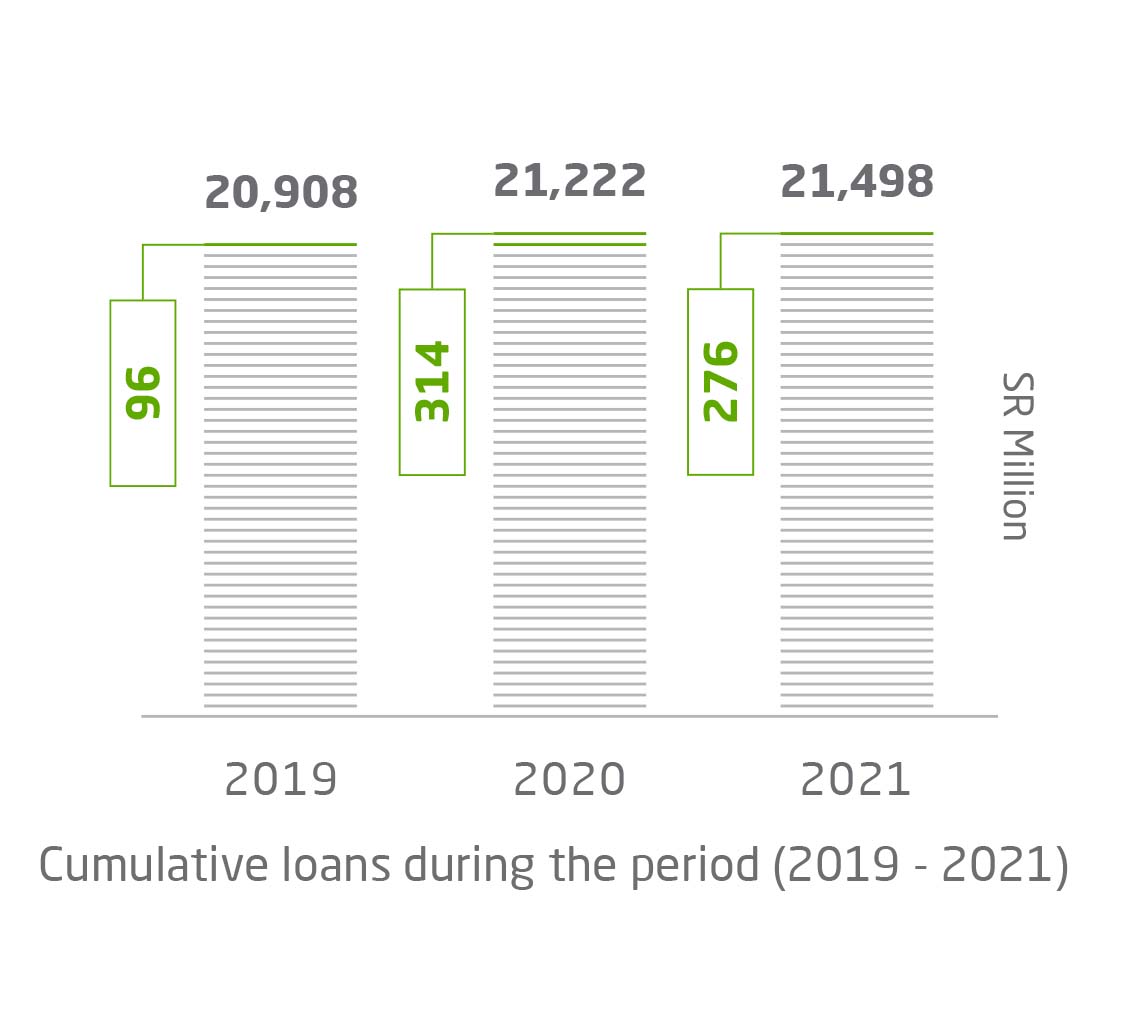

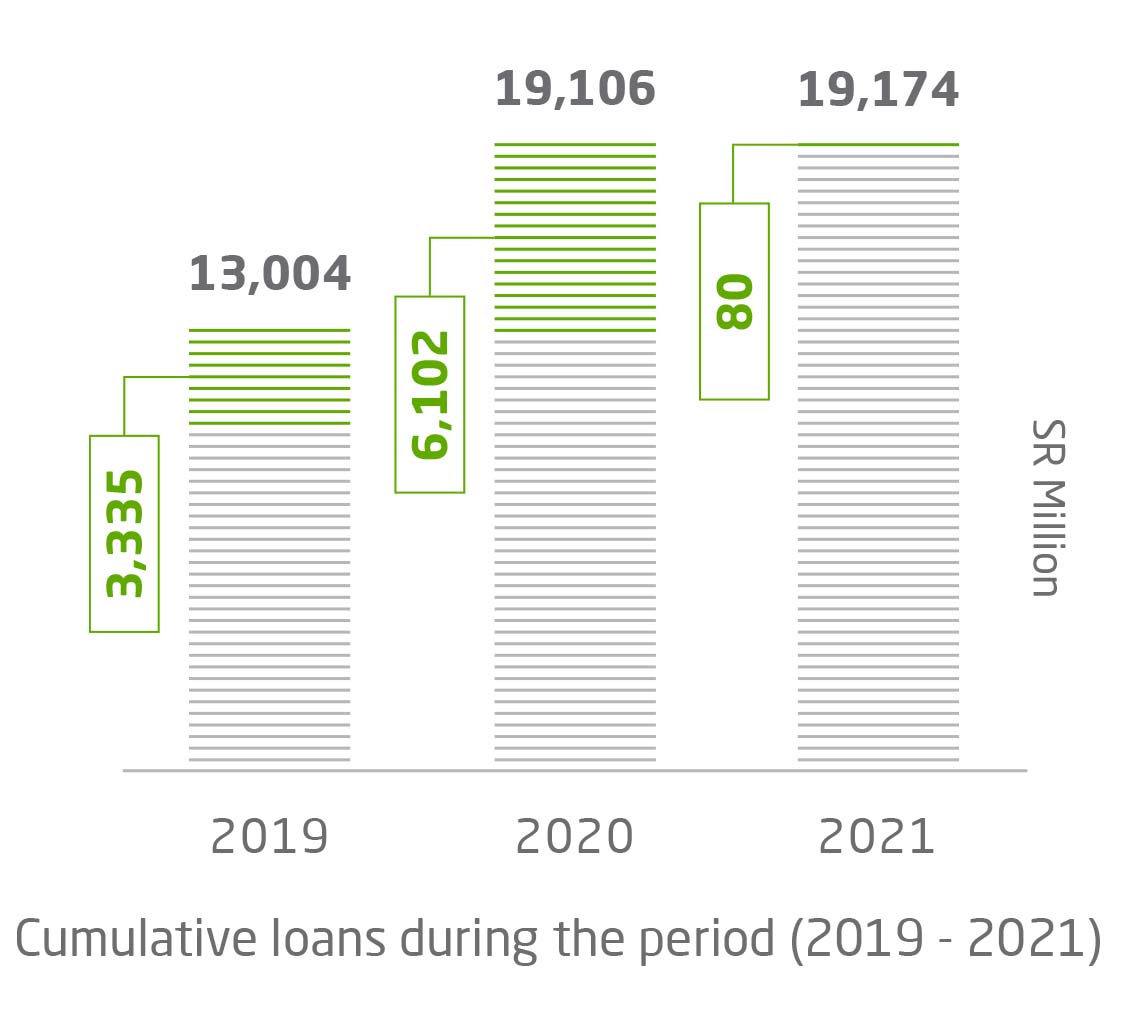

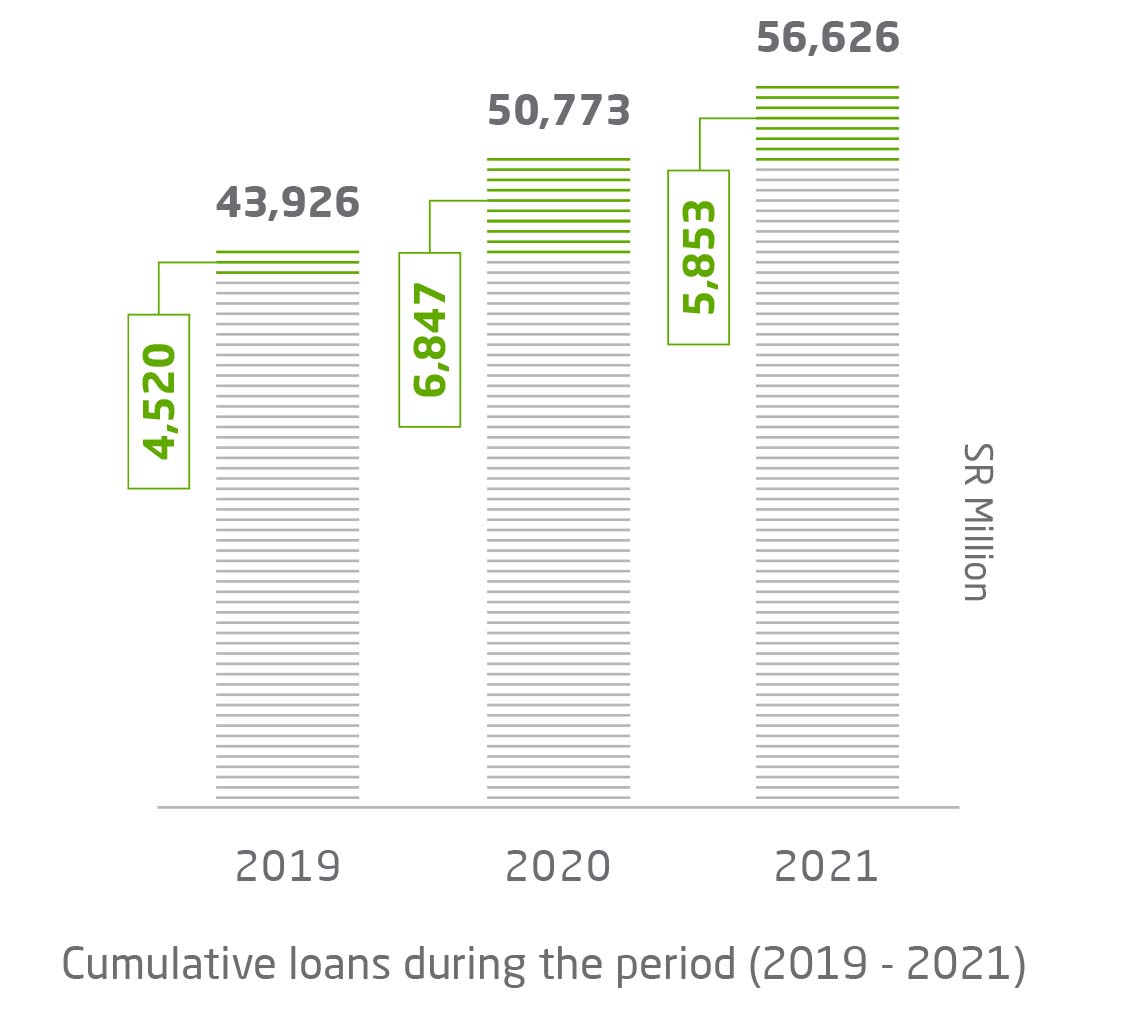

Cumulative Lending Activity until the End of 2021

Overall, the figures achieved by the Fund from its inception to the end of the fiscal year 2021 demonstrate the success of the projects benefiting from its loans, as well as the Fund’s advisory support to these projects in technical, administrative, financial and marketing areas.

0

Number of approved loans

0

Value of approved loans

0

Disbursed amounts

0

Repaid amounts

0 %

Total repayments to total disbursements

Economic Impact of SIDF Loans during 2000-2021

0

ThousandNew job opportunity in funded projects

0

SR BillionValue of industrial exports for funded projects

0

SR BillionValue of funded projects purchasing local raw materials

0

SR BillionValue of GDP from funded projects

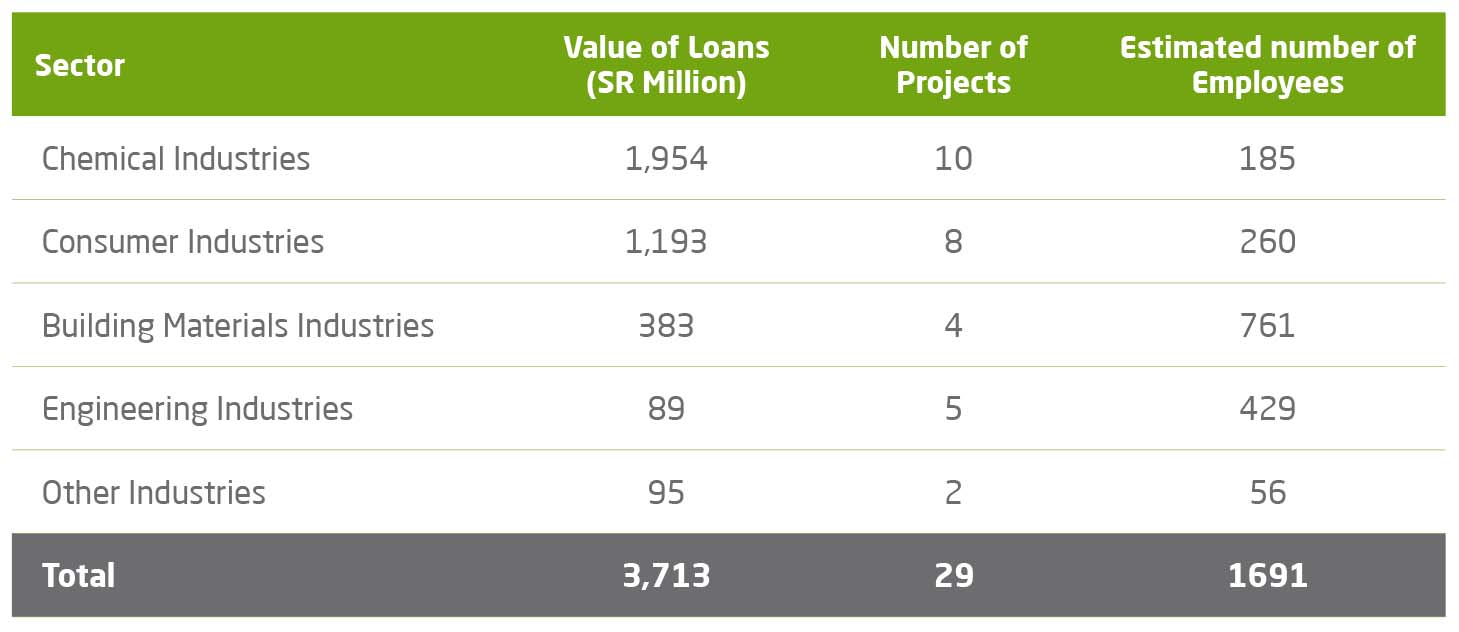

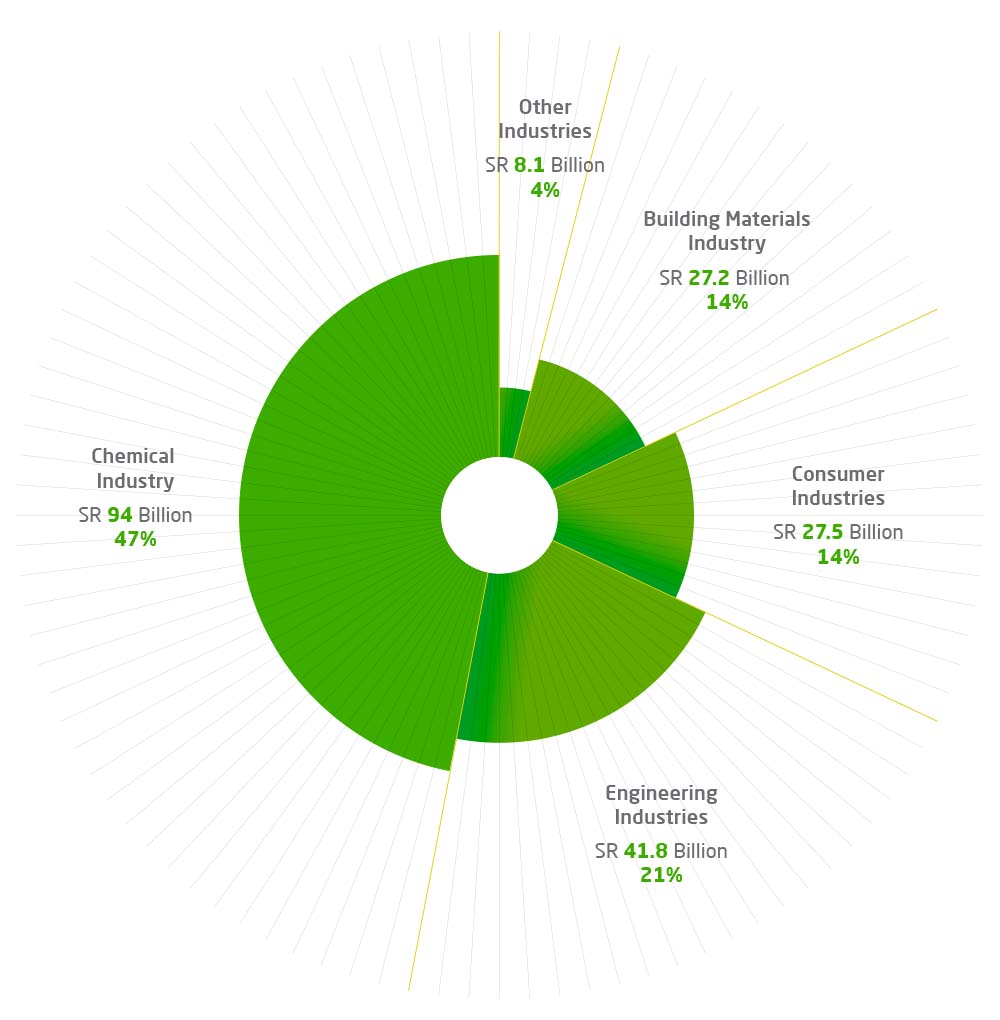

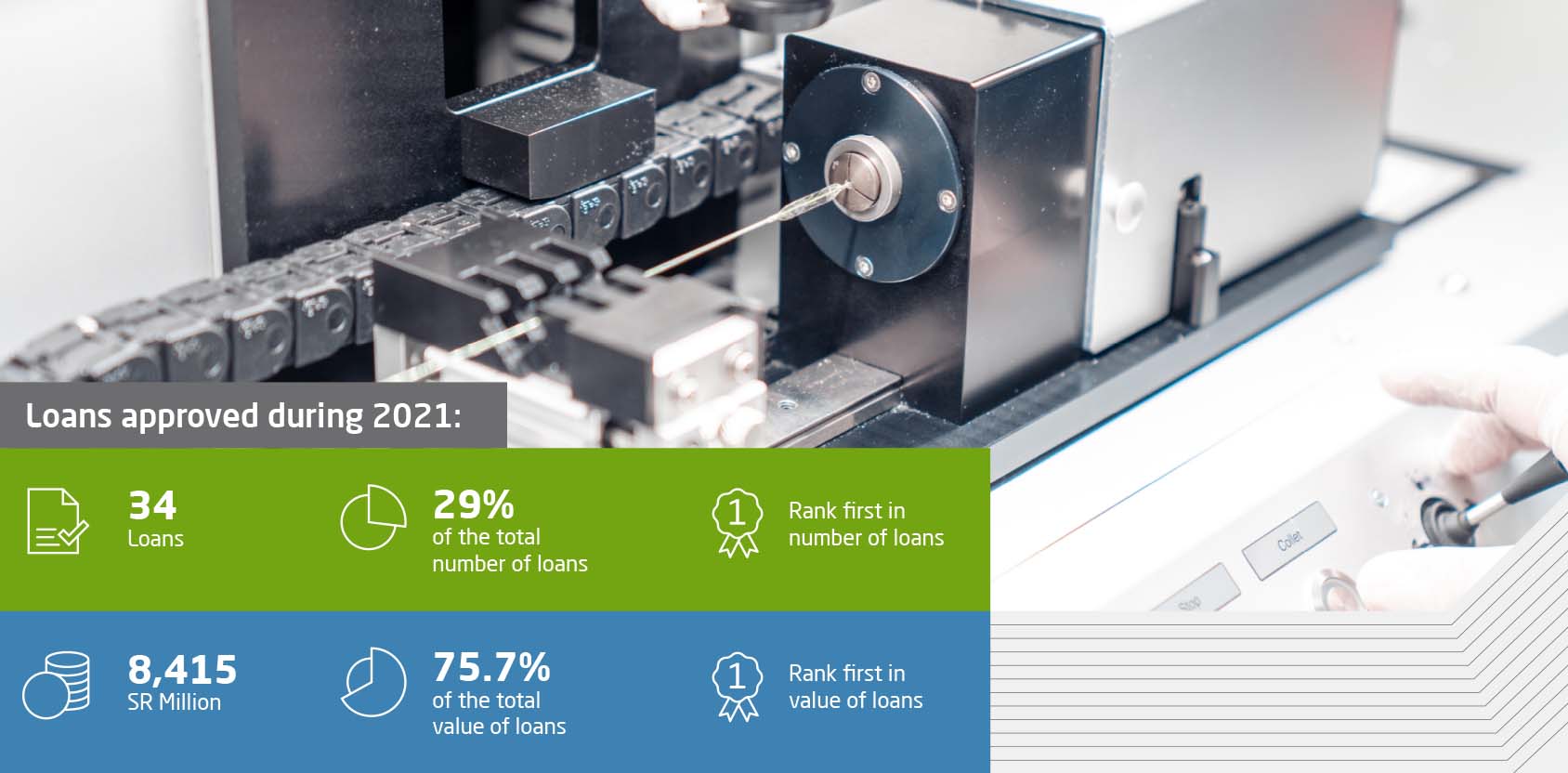

First: Sectoral Distibution

By reviewing the Fund’s lending activity covering the key industrial sectors in Saudi Arabia, by the value of the loans it has approved, it is clear to us the size of this activity of the last fiscal year 2021, as follows:

Sectoral cumulative distribution of the value of approved loans until the end of 2021

1.1 Chemical Industries

New loans approved:

0

SR Millionto produce hydrogen gas in Jubail city

0

SR Millionto manufacture and produce packaging products in Jubail and Hafuf cities

Cumulative loans approved until the end of 2021

0

SR Million

0 %

of the total value of loans

Rank first in cumulative loans value

1.2 Engineering Industries

New loans approved:

0

SR Millionto produce electric vehicles in Rabigh city

0

SR Millionof Metal Casting and Roads Factory in Ras Al Khair city

0

SR Millionto establish two projects to manufacture steel pipe and coating pipe

Cumulative loans approved until the end of 2021

0

SR Million

0 %

of the total value of loans

Rank second in

cumulative loans value

1.3 Consumer Industries

New loans approved:

0

SR Millionfor the establishment of a factory manufacturing white sugar in Yanbu city and the other for the manufacture of frozen potato slices and starch in Al Jowf city

0

SR Millionto establish a factory to manufacture frozen pastry in Riyadh city

Cumulative loans approved until the end of 2021

0

SR Million

0 %

of the total value of loans

Rank third in cumulative loans value

1.4 Building Materials Industry

New loans approved:

0

SR Millionto set up a factory to manufacture cement panels in Yanbu city

0

to establish a factory for the production of fiberglass rods in Dammam city

Cumulative loans approved until the end of 2021

0

SR Million

0 %

of the total value of loans

1.5 Other Industries

New loans approved:

0

SR Milliona project to equip prefabricated factories, and another for the project of refrigerated warehouses in Jeddah city

0

SR Millionfor logistics projects at Riyadh, Jeddah, and Dammam airports

Cumulative loans approved until the end of 2021

0

SR Million

0 %

of the total value of loans

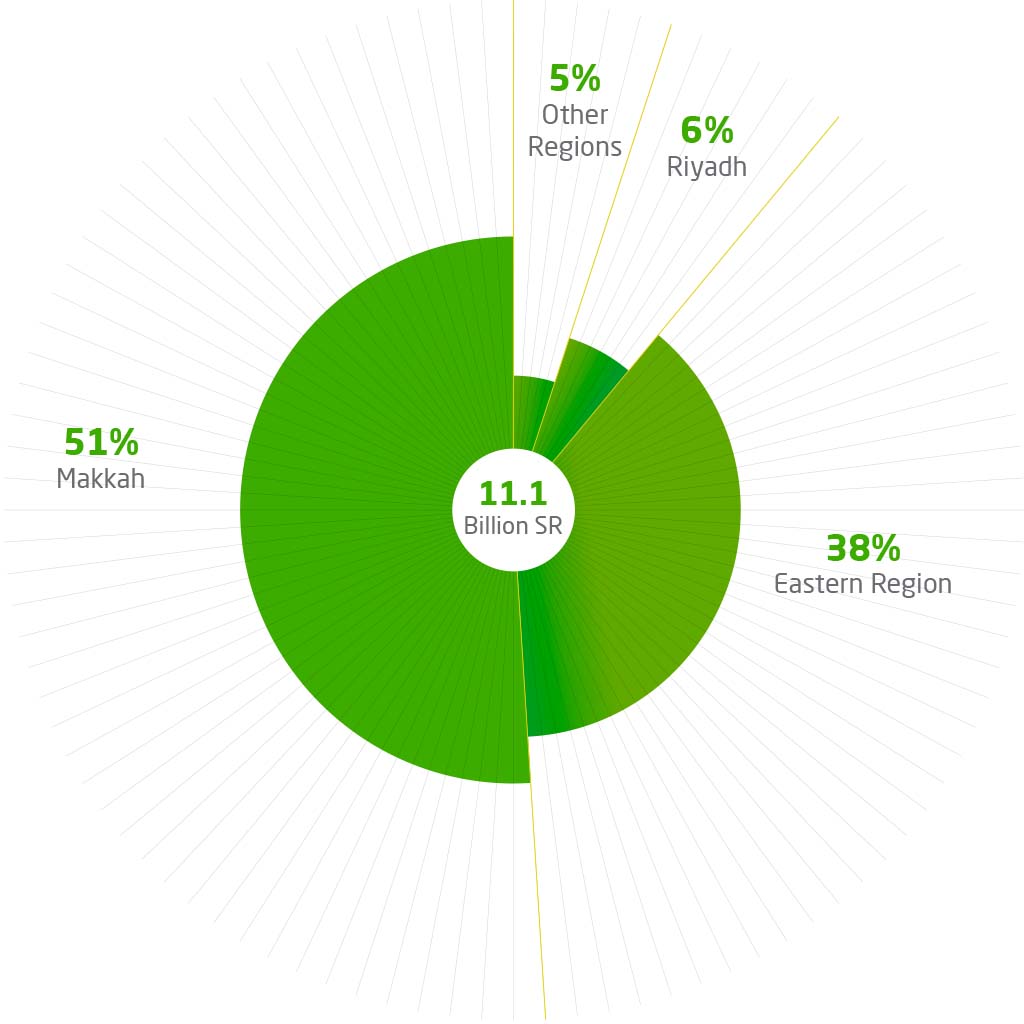

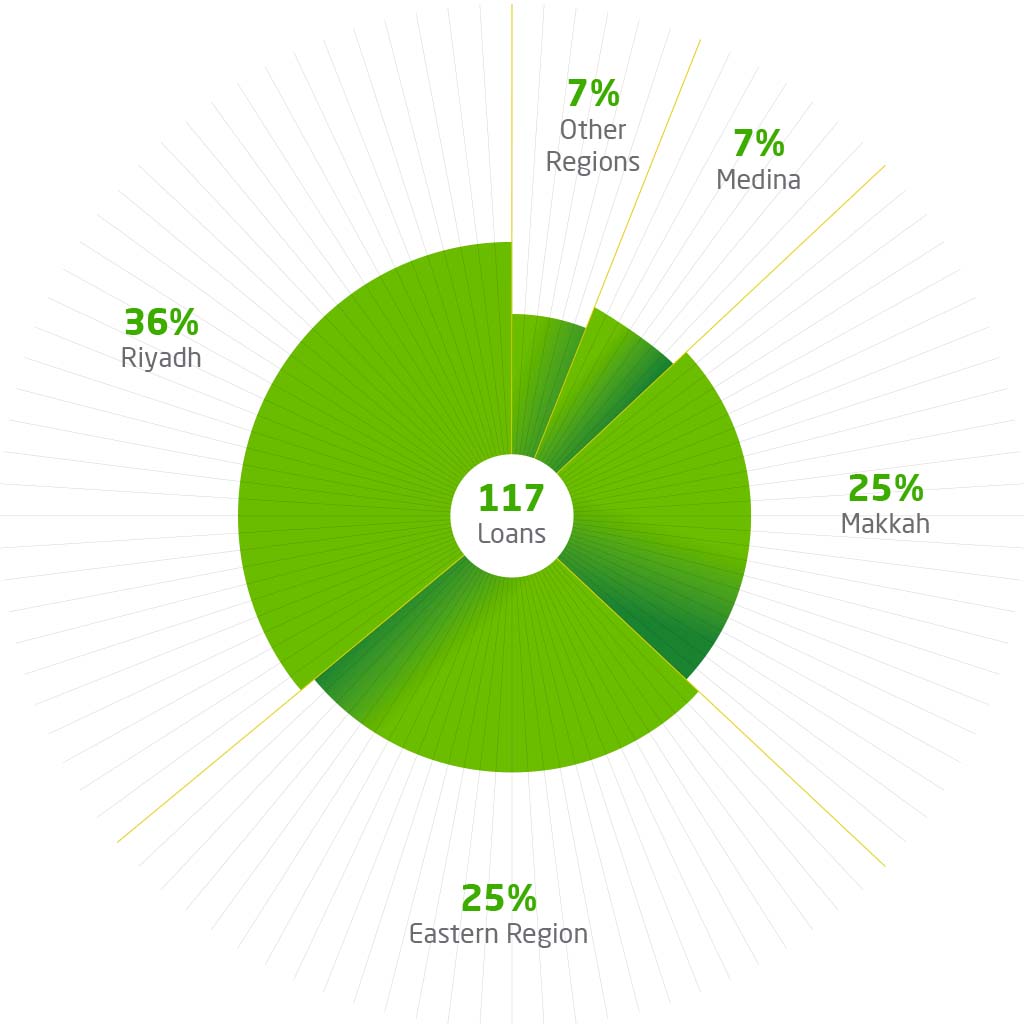

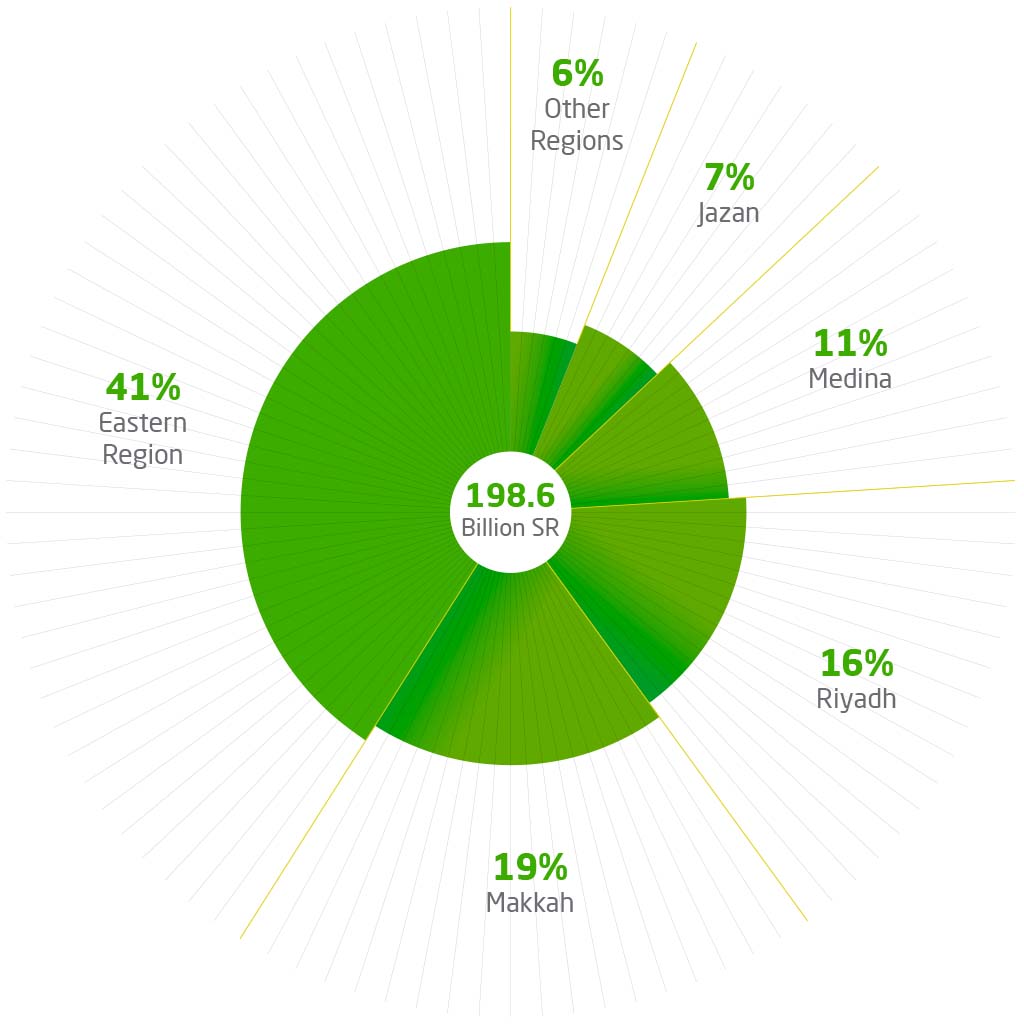

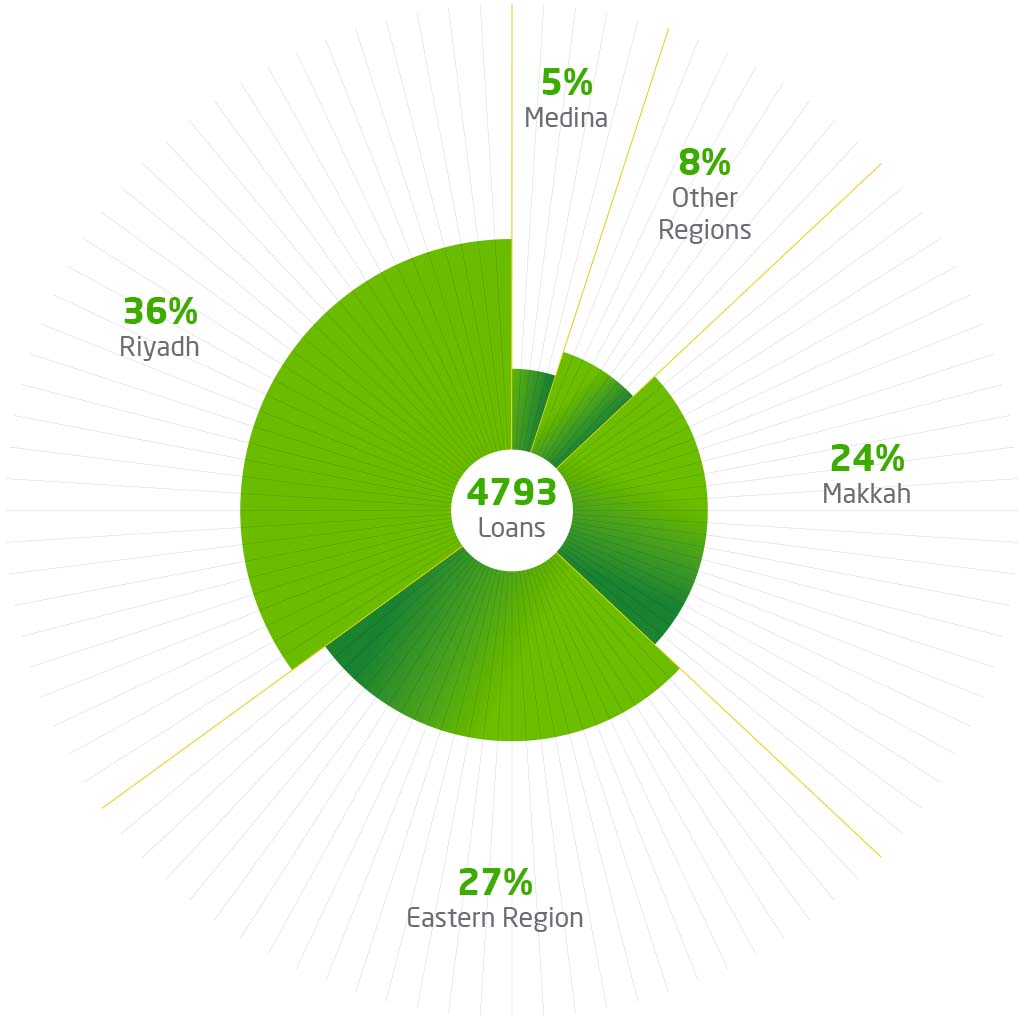

Second: Geographical Distribution

Figure of geographical distribution of total SIDF approved loans, in terms of number and value of loans, across regions of the Kingdom until the end of 2021

Percentage Distribution of Approved Loans in 2021

Cumulative Percentage Distribution of Approved Loans until end of 2021

2.1 Riyadh Region

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

Rank first in number of loans

0

SR Million

0 %

of the total value of loans

Rank third in value of loans

2.2 Makkah Region

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

Rank third in value of loans

0

SR Million

0 %

of the total value of loans

Rank third in value of loans

2.3 Eastern Region

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

Rank third in value of loans

0

SR Million

0 %

of the total value of loans

Rank third in value of loans

2.4 Medina Region

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

Rank fourth in number of loans

0

SR Million

0 %

of the total value of loans

Rank fourth in number of loans

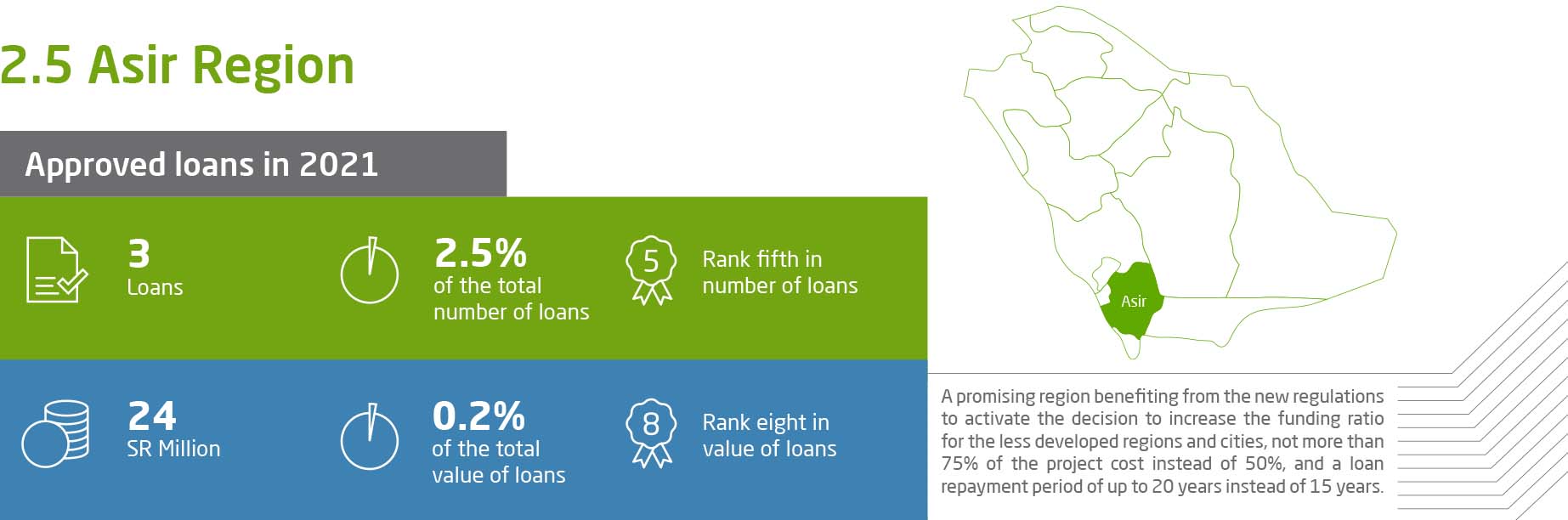

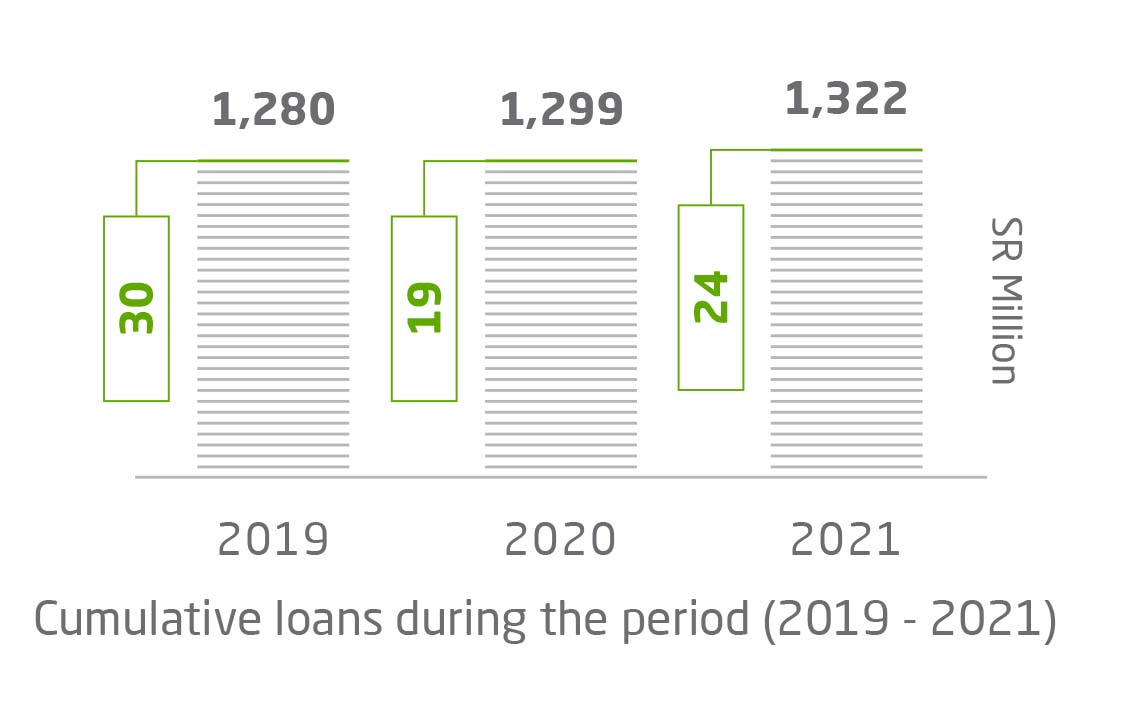

2.5 Asir Region

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

Rank fourth in number of loans

0

SR Million

0 %

of the total value of loans

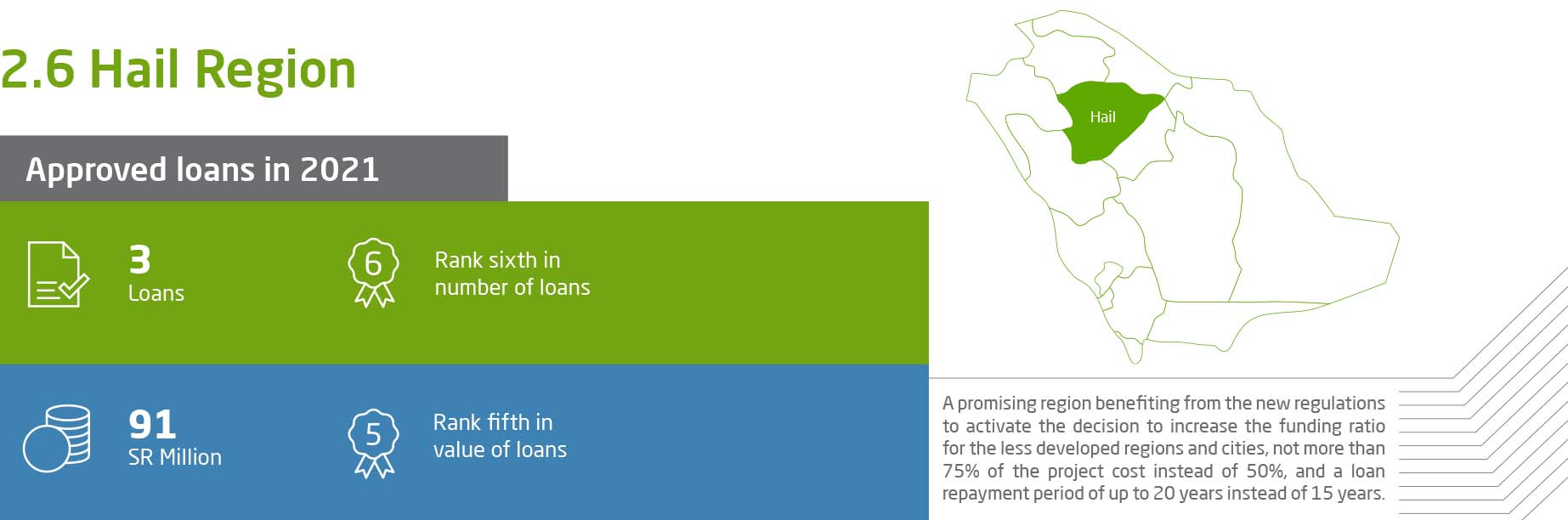

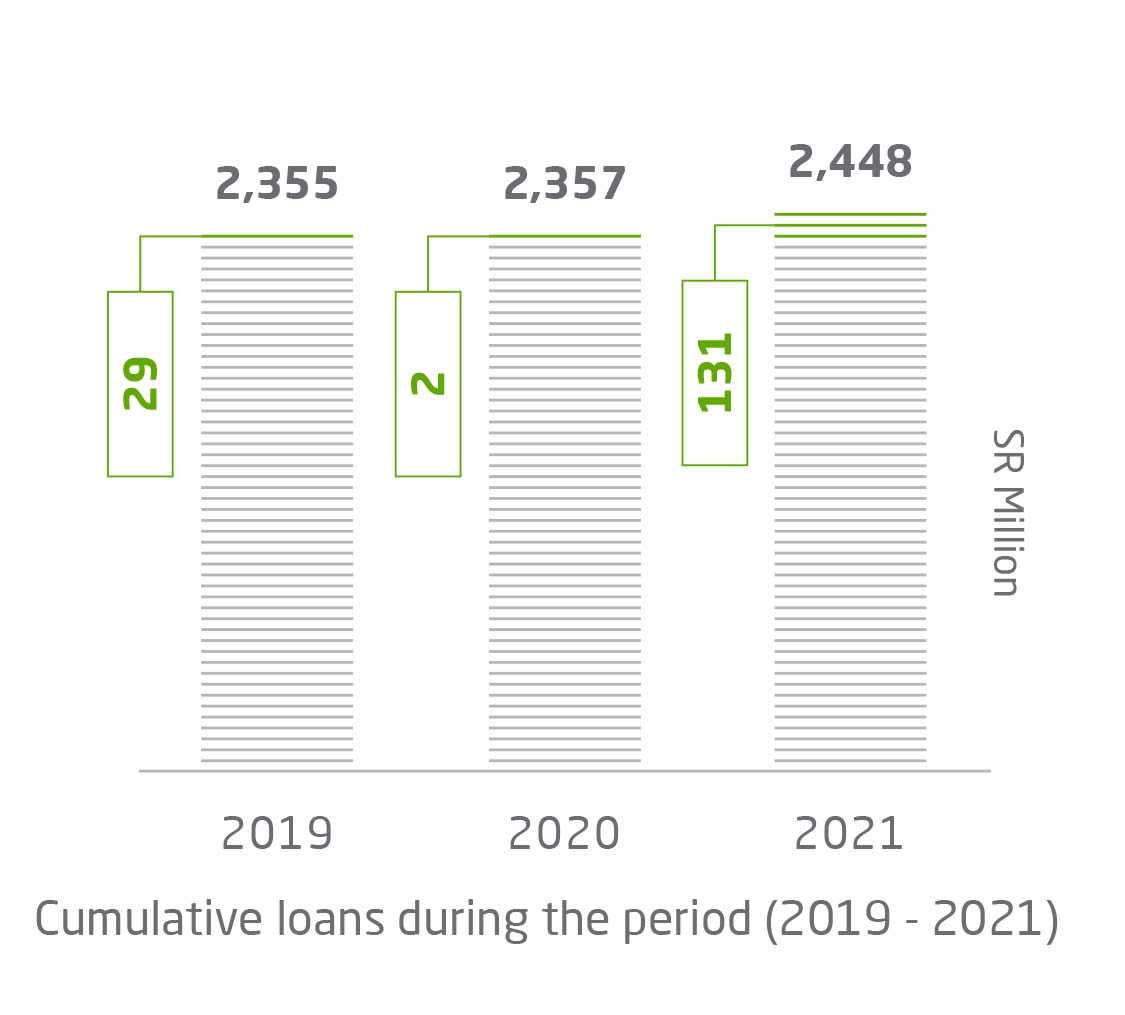

2.6 Hail Region

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

Rank sixth in number of loans

0

SR Million

0 %

of the total value of loans

Rank fourth in number of loans

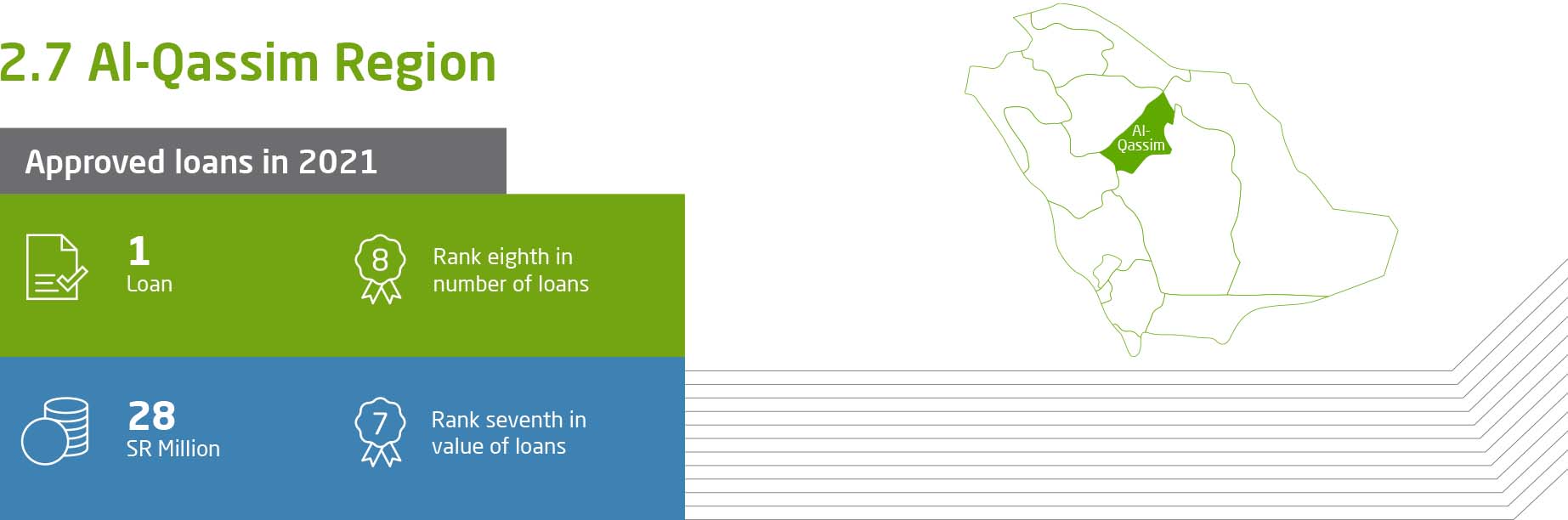

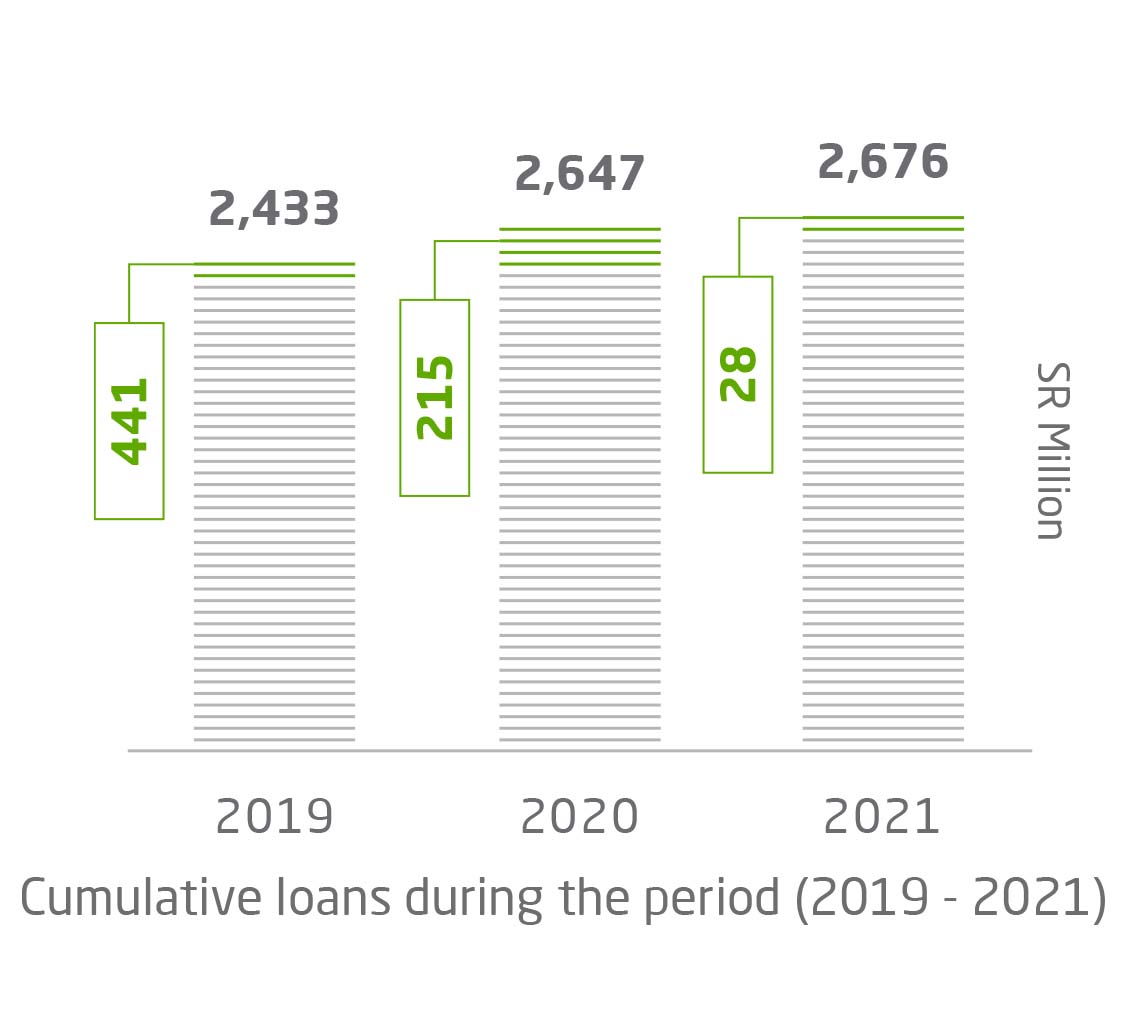

2.7 Al-Qassim Region

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

Rank fifth in number of loans

0

SR Million

0 %

of the total value of loans

Rank seventh in number of loans

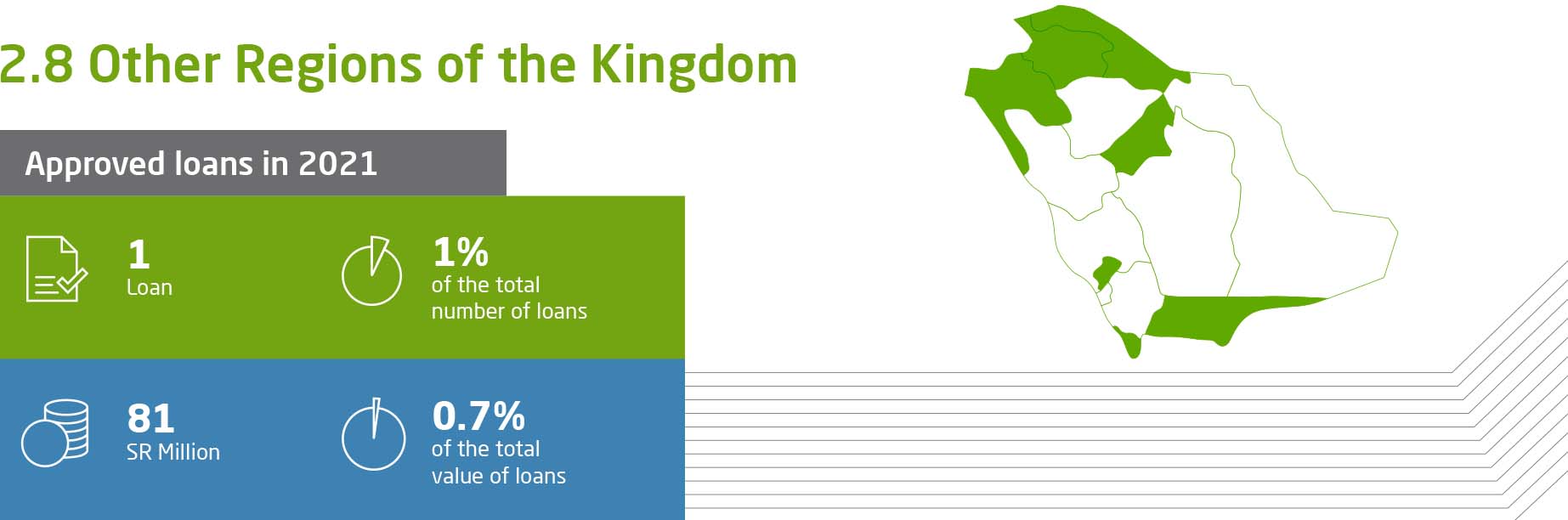

2.8 Other Regions of the Kingdom

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

0

SR Million

0 %

of the total value of loans

2.9 Promising Regions and Cities

The SIDF Board has adopted new regulations and features that outline the percentage of SIDF financing for industrial projects in promising regions and cities across the Kingdom. These regions are located outside the parameters of central Saudi regions and cities. The initiative was in response and compliance with Resolution no. 296, issued by the Council of Ministers on 14/10/1432H (12/09/2011), with a vision for the industrial sector to transform and expand into a regionally-inclusive sector. The Resolution approved raising loans granted by SIDF for projects in less developed regions and cities (promising regions), covering up to 75% of the total project cost -- rather than 50%-- and extending the loan repayment period to up to 20 years rather than 15.

Cumulative loans approved until the end of 2021

0

Loans

0 %

of the total number of loans

0

SR Million

0 %

of the total value of loans

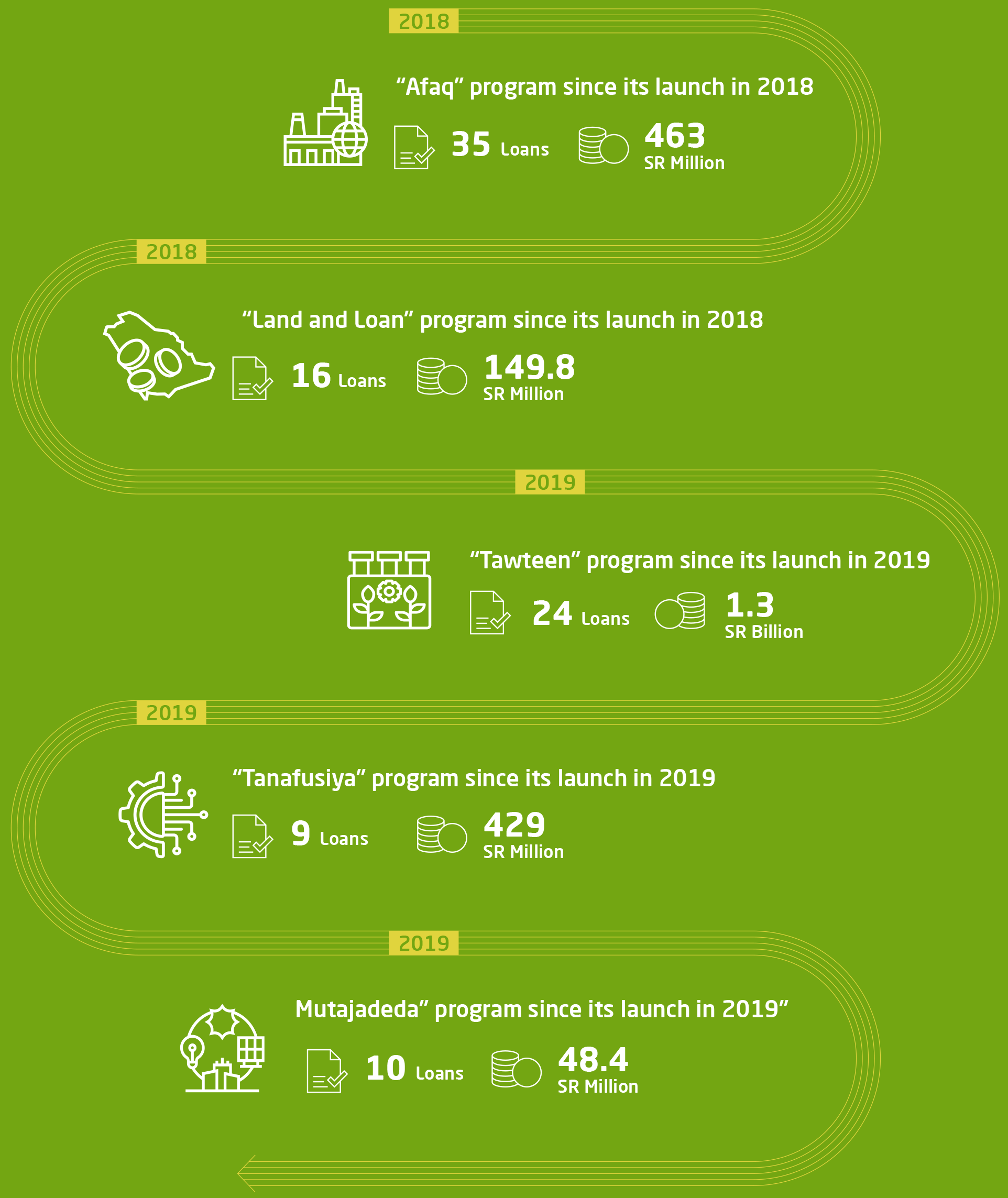

Third: Approved Loans Classified by Financial Program and Product

Applying SIDF strategy to support the diverse industrial activity environment in the Kingdom on an ongoing basis; In an effort to create attractive and promising investment environments through which to motivate all investors in start-ups, promote digital transformation and increase the energy efficiency of existing projects; SIDF has launched an integrated package of specialized financing programs and products, including:

3.1 Financial Programs in 2021

“Tawteen” program to raise local content through partnerships with major companies

“Tanafusiya” program to improve factory efficiency and support automation to raise productivity and competitiveness

0

Loans

0

Loans

0

SR Million

0

Loans

“Afaq” program to enable SME Empowerment

The “Land and Loan” program is integrated with a number of government and private entities

“Mutajadeda” program to stimulate investments in the renewable energy components industry and support independent energy projects

0

Loans

0

SR Million

3.2 Financing programs from launch to 2021

3.3 Financing Products in 2021

Working Capital Financing

0

Loans

0

SR Million

Multipurpose Financing

0

Loans

0

SR Million

Letter of Credit with Local Banks

0

Letters of Credit

0

SR Million

3.4 Financing Programs from launch to 2021

Working Capital Financing

0

Loans

0

SR Billion

Letter of Credit with Local Banks

0

Letter of Credit

0

SR Billion

Multipurpose Financing

0

Loans

0

SR Million

Financing supply chains

0

Loan

0

SR Million

Fourth: Financing Foreign and Joint Ventures

Since its inception, SIDF has been encouraging foreign and joint ventures industrial projects and achieving industrial ambitions in line with the aspirations of the Saudi Vision 2030. Attracting FDI is one of the objectives of the Strategic National Transformation Program to contribute to empowering the private sector, attracting and transferring the Kingdom’s modern technology and creating new jobs for citizens. In addition to its pivotal role in opening up global markets for national products, SIDF has paid particular attention to attract foreign investment, especially with long-standing global companies. Whether with Saudi partners or wholly foreign ownership, these projects are dealt with on the same basis as those owned by Saudi investors.

4.1 Approved loans for foreign and joint ventures during 2021

0 +

Loans

0 %

of the total approved loans

0

SR MillionLoans

0 %

of the total value of approved loans

0

Projects in Consumer Industries

0

Projects in Chemical Industries

0

Projects in Engineering Industries

Impact of financing foreign and joint ventures during 2021

0 +

Job opportunity provided out of a total of 11,812 jobs

0 %

Of total employment opportunities in projects loaned by SIDF

4.2 Cumulative loans approved for foreign and joint ventures until end of 2021

0

Loans

0 %

of the total number of approved loans

0

SR Billion

0 %

of the total value of approved loans

0 %

Average foreign partner’s contribution to joint ventures

0 %

Projects in the chemical industries

0 %

Project in engineering industries

0 %

Projects in consumer industries

Fifth: Projects Started Production in 2021